International Student and Scholar Services (ISSS) encourages all international students and scholars to file taxes in compliance with federal and state tax regulations. ISSS Advisors are unable to give individual tax advice. Please email ip-vita@uiowa.edu with questions concerning the Alert and/or other information below.

Tax Resources for 2024 Tax Year Filing

Tax Season is here and this year the ISSS is collaborating again with the Johnson County VITA Program to set up a special set of workshops specifically for F1/J1 international students and scholars. These workshops are separate from the regular Johnson County VITA program done at the Iowa City Public Library and are specifically designed to help UI International students and scholars file their 2024 non-resident federal and state returns.

UPDATE 2/17/2025: The updated workshop schedule for Spring 2025 will appear by clicking on the “Workshop Sign-Up Process” link below and the process for signing up for one of the sessions of the workshops dates is also described. The iHawk sign-up process will not go active until near the end of the final week of February. First-time workshop participants must sign-up and attend a workshop session and will be given access to ICON materials once they sign-up in iHawk. Returning participants who filed through these VITA workshops last year and already have access to the ICON course will see the updated materials and guidance for 2024 tax filing posted in ICON during the final week of February. While returning participants from last year are not required to sign up for and attend a session, they are still strongly encouraged to do so since the workshops are the only place trained volunteers will be available to advise on specific tax and software questions.

These workshops are primarily designed to assist UI students and scholars to file their Non-Resident tax filings for the most recent tax year, 2024. International students and scholars who have been in the US long enough to be considered “Residents for tax purposes” and need to file a Resident return can also be served by these workshops. Those wishing to file or amend tax filings for previous tax years will not be a priority for Volunteers’ time during the Workshop sessions even though the software available through the workshops is capable of producing both 2023 and 2024 filings. The workshops describe above and below are just one option available to F1 and J1 filers for filing their Non-Resident tax filings. Another widely known option for correctly filing non-resident tax returns is a fee-based private software available at Sprintax.com. International students and scholars who earned income during 2023 and did not file a return last tax season may also want to investigate Sprintax.com since that is a resource known to permit filing 2023 taxes along with this year’s 2024 tax filing.

During your workshop session VITA volunteers trained in tax treaties will be available to assist you as you complete the free tax filing software provided. This software will help you complete your Federal and State returns. The sign-up process and the documents you must bring to your session are listed below.

Workshop Sign-Up Process

The sign-up process will be made available February 28th and once open students and scholars will be able to secure a session spot by logging into iHawk. Depending on whether you log in on a computer or mobile device, the Events section will either be on the right-hand side of your screen or below the sections for Notifications and Requests.

To see all available sessions, click on the button at the very bottom to “See More Events.” For sessions scheduled more than 30 days out you may need to click to view since those may not readily appear.

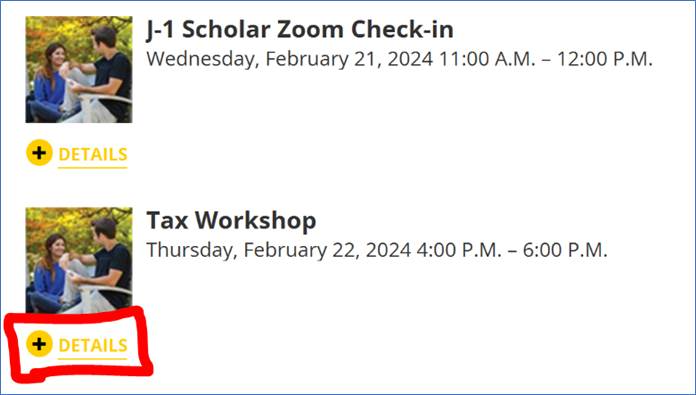

You can then scroll through the list of upcoming events to find the "Tax Workshop" events. If you click the small “+” button where it says Details, you can read about what materials you need to bring.

Finally, you can sign up for the event by clicking the button for “I’m Going” at the bottom of the details.

These 2-hour workshop sessions will be held on the dates and times below and space is limited, please sign up as soon as you receive the informational email. Please sign up for only one session and if you sign up but later decide that you do not plan to attend, the please unclick the “I’m Going” box in iHawk so your seat can be made available for someone else.

- Wednesday, March 5, 4-6p.m., 1117 UCC

- Wednesday, March 5, 6-8p.m., 1117 UCC

- Friday, March 14, 4-6p.m., 1117 UCC

- Friday, March 14, 6-8p.m., 1117 UCC

- Thursday, March 20, 4-6p.m., 1117 UCC

- Thursday, March 20, 6-8p.m., 1117 UCC

- Tuesday, March 25, 4-6p.m., 1117 UCC

- Tuesday, March 25, 6-8p.m., 1117 UCC

- Wednesday, March 26, 4-6p.m., 1117 UCC

- Wednesday, March 26, 6-8p.m., 1117 UCC

In the days prior to your workshop session you may also receive by email several worksheets that are also listed in the ICON materials. These worksheets gather the information needed to prepare your return. You must complete these worksheets before arriving at your workshop session.

Please know that the ISSS is separate from these International Workshops but will be assisting with information distribution and organizing the sign-up process. This ip-vita@uiowa.edu email account of the ISSS is generally for providing basic information about available tax resources. However, trained tax workshop volunteers will be able to field specific tax questions via the ip-vita@uiowa.edu for participants once the workshops have begun. Generally, individual tax advising questions should be directed to the specific resource (Workshops Volunteers at the workshop, Sprintax.com, Private Tax Preparer) chosen to assist. ISSS advisors are prohibited from offering tax advice.

What to bring to the workshops

- Your own laptop

- Your completed worksheets (the worksheets we email to you several days before your session)

- Your Immigration Documents (most recent I-20/DS-2019, Passport, Visa, I-94). If you have dependents, bring their documents as well.

- Your I-94 and I-94 Travel History to calculate the number of days present in the US during 2024 and prior years (ink entry stamps in passport and an online date calculator can also help calculate this).

- Your Social Security Card or ITIN Letter.

- All forms W-2 and/or 1042-S for 2024 that were mailed to you or available on either the UI Self Service Site or through FNIS. If you are unsure about whether to bring a document, you should bring it.

- Any other forms or documents you received for 2024 that say "also provided to the IRS" or are identified as 1099, 1098, W2-G forms. Bring any type of 1099 or 1098 that you received for 2024

- Your bank routing number and checking account number for direct deposit of your refund.

- Your mailing and residential address as well as your home country address information.

- If you have filed taxes previously, a copy of your 2023 federal and state tax documents (this includes 1040/1040NR, 8843, W-2, 1042-S, etc..)

- The visa status you had in every year that you visited or lived in the US prior to holding the status you now have.

Filing Deadlines

- Federal Taxes: April 15th, 2025

- Iowa State Taxes: April 30th, 2025

- Form 8843 only (no income earned): June 15, 2025

Please note that all non-residents (for tax purposes) who were present in the U.S. in F-1, F-2, J-1, J-2, M-1, or M-2 status during 2024 must file Form 8843, even if they received no income during 2024. If you made no income during 2024 and only need to file the 8843 please email ip-vita@uiowa.edu to request directions on how to complete the 8843.

Caution: Non-residents should not use standard commercial tax preparation software, such as Turbotax. Many of these programs are not meant to be used for non-resident tax purposes and will cause you to submit incorrect tax information to the U.S. and Iowa governments.

Resident or Non-Resident for Federal Tax Filing Purposes

Generally, most international students & scholars who are on F or J visas are considered non-residents for tax purposes. If you are an international student who arrived in the U.S. for the first time on an F or J visa in 2020 or later, you will be a non-resident for tax purposes for your 2024 tax return. If you are an international scholar, researcher, or post-doc, who arrived in the U.S. for the first time on a J visa in 2023 or 2024, then you will be a non-resident for tax purposes for your 2024 tax return. In most other cases, you will be considered a resident for tax purposes, but note that the rules are more complicated than our simple explanation of non-residents for tax purposes above. As an international student or scholar, you may also have tax treaties that apply to you - these treaties sometimes apply to you even after you become a resident for tax purposes.

For help clarifying your Resident or Non-Resident tax filing status please consult sign up for the VITA Tax Workshops once they become available and resources on the ICON site along with VITA volunteers at the workshops can help you determine your tax status. The UI Payroll Office is also a resource throughout the year to clarify your tax filing status and they can be emailed at payroll-nra@uiowa.edu.

If, from the Resident vs. Non-resident information above, you believe you are a Resident for tax purposes, or if you have a very complicated immigration or tax history that makes you unclear about your tax filing status, we recommend you seek the advice of a tax professional, use Sprintax.com or sign up for the special VITA workshops for int'l students and scholars in March once the sign-up email is sent near the end of February.

Sprintax.com (a for-fee software) also permits filing of the 2023 tax year returns along with this tax season’s 2024 returns. By setting up a Sprintax.com account and completing only the first part of the online process can also assist students to determine for sure if they should be filing as a Resident (and therefore not need Sprintax.com) or a Non-Resident (in which case the student can decide if they would like to continue with Sprintax.com to help them file their tax return for a fee).

Things Needed as You Prepare to File a Non-Resident Tax Return

Information from the items below are generally needed for completing a non-resident filing or non-resident tax software so please arrange to have access to this information when using the tax filing resources mentioned above:

- Passport and Visa

- Your "Travel History" from the digital record from the I-94 Government Website. To complete the tax filing you must calculate the number of days you were present in the US during the past tax year and prior years. Dates from the I-94 site, as well as the ink entry stamps in your passport, can be used with any Online Date Calculator to help you establish the number of days you were present in the US during a tax year.

- Form I-20 (if an F status individual) or Form DS-2019 (if a J status individual)

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you have no SSN or ITIN yet visit our SSN page.

- All Forms W-2 and/or 1042-S that were mailed to you or available on the UI Self Service site. The W-2 forms generally become available at the end of January every year while 1042-S form are produced in late February. Please email the UI Payroll Office at payroll-nra@uiowa.edu if you have any question about these forms.

- Your bank routing number and checking account number for direct deposit of your refund. These numbers are located on your personal checks from your bank.

- A copy of your 2024 (TY2023) federal income tax form (Form 1040NR) if you filed a federal income tax return last year. The most important information needed from these documents is the amount of the Adjusted Gross Income(AGI) from the past 1040NR. If you are not able to obtain any copies of your last year's 1040NR then you may have to request an AGI transcript directly from the government. The online option may not work for many students so they must request a paper AGI transcript to be sent to them using their prior year's mailing address (which is the only way to verify your identity, and is problematic if you have a new address).

- Address Information (Current U.S. Address if you are still living in the U.S. and Permanent Foreign Address)

- Academic Institution or Host Sponsor Information

- Scholarship or fellowship grant letters (if you received one from your academic institution or host sponsor)

- UI Human Resources Payroll Office collects and maintains data to determine nonresident alien vs. resident alien status for tax purposes. W-2 forms are made available in mid-to-late January through MyUI or through the UI Employee Self-Service website. Students can view their W-2 and other tax information by going to the “Student Records” tab in MyUI and in the “Finances and Billing” section click on the “HRIS Self Service and Earnings Statements” link. That link will bring you to the Employee Self Service site and under the “Payroll” section you can select “View Year End Tax Information” to get a PDF of your W-2.

- International students or scholars may or may not have a 1042-S form depending on different circumstances. For details, please go to the Employee Self Service , and in the “Time and Pay” select the “Year End Tax Information” link in the "Taxes" section to find the then “1042-S Foreign Person’s U.S. Source Income Subject to Withholding.” If you have any inquiry about your form W-2, 1042-S, tax treaties, payroll and withholding of taxes, please call or visit the UI Payroll Office or email payroll-nra@uiowa.edu.

A Warning About Other Tax Services

If you are classified as a non-resident, you may NOT file a resident return. Residency, for tax purposes, is determined by the “Substantial Presence Test”, but if you are in the U.S. on an F or J visa, certain years you are in the U.S. are exempt from the Substantial Presence Test. Again, F-1 and J-1 non-residents should not use standard commercial tax preparation software, such as Turbotax, unless they are sure that they qualify as residents for tax purposes (see above). Many of the most prominent tax filing software programs are not meant to be used for non-resident tax purposes and will cause you to submit incorrect tax information to the U.S. and Iowa governments.

Only those who are determined to have "resident" filing status may complete a resident return. Most students and scholars will be classified as non-residents for tax purposes. Also, some tax agencies have erroneously filed resident returns for non-residents promising larger refunds by this method. This could result in a charge of tax fraud against you, which may jeopardize your legal status. The fact that your preparer erred will not excuse you from liability. The UI Payroll Office is a resource for determining your residency and tax liability so please contact payroll-nra@uiowa.edu with any questions. ISSS urges you to protect yourself in this matter or you may have to file an amended return and pay back any fraudulently refunded funds.

Warning about Tax Scams and Fraudulent Emails

The Internal Revenue Service (IRS) does not discuss tax account information with taxpayers via e-mail or use e-mail to solicit sensitive financial and personal information from taxpayers. For more information, view the following webpages provided by the IRS.

Online Scams that Impersonate the IRS

Suspicious Emails

Information about Tax Scams/Consumer Alerts

Resources relating to international student and scholar tax

“Ten Common Tax Return Errors and the Foreign Nationals Who Make Them”

United States Income Tax Treaties - A to Z

Nafsa Federal Income Tax Brochure This brochure is designed to offer general guidelines only for federal income tax obligations, including determining tax residency and which forms must be filed and when.

VITA for residents (sponsored by UI College of Business)

State of Iowa Department of Revenue

Tax Information for Employers of International Students

Employers may legally hire students in F-1 or J-1 status for academically-related employment when they receive Curricular Practical Training (CPT), Optional Practical Training (OPT), or Academic Training (AT) authorization.

Types of Employment Authorization

| CPT | In some cases, internationals students in F-1 status pursuing degrees at the UI are eligible for internships or other types of work experience in their fields of study. This permission is granted by ISSS and submitted to SEVIS, the federal immigration informational database. |

| OPT | Following graduation or completion of coursework, most students in F-1 status are eligible to accept up to 12 months of employment for "optional practical training" experience. This authorization is granted by U.S. Citizenship & Immigration Services. OPT is an extension of F-1 status that allows for a period of work following graduation. |

| AT | J-1 students are eligible for academic training, either during the course of study or directly after graduation. The authorization is granted by ISSS and submitted to SEVIS. |

Taxes

Students who have been in the U.S. less than 5 years (and are therefore nonresidents for tax purposes) and who are on practical training off-campus are not subject to any FICA (social security) and Medicare withholdings. The mechanism for the exemptions are found under Internal Revenue Code 3121 (b)(19) and is available to persons in F-1, J-1, M-1 and Q immigration status. It is a blanket exemption with the only qualification being that the person be a nonresident for tax purposes and that the work is authorized (CPT, OPT, AT). IRS Publication 519 is a good resource.

Though F-1 and J-1 students working off campus are exempt from FICA, they are subject to the higher federal (and state) withholding for nonresident aliens.

Since it is cumbersome to request a refund of taxes withheld in error, ISSS would like to ask employers to make a determination of the student’s tax status prior to withholding. In most cases, the student will be a nonresident alien and therefore not subject to the taxes mentioned above.

Completing the I-9

The employer should mark in Section 1 that he/she is "an alien authorized to work until" (date of expiration of work authorization). The admissions number is the 11 digit number given on the I-94 entry document.

For students on Optional Practical Training, the employer can use the I-688B to complete List A on the I-9. The document title is "Employment Authorization Document", issuing authority is USCIS, document number and expiration can both be found on the front of the card.

For further information, see the U.S. Department of Justice Handbook for Employers, Publication M-274.

Student Responsibilities

It is the responsibility of the student to insure that the job they take on practical training is related to the degree they are seeking or has completed at The UI. The student is also responsible for maintaining contact with The UI, as the institution is still responsible for the student’s legal status in the U.S. Under federal immigration law, student’s have 10 days to report a change of name or address to the UI.

Disclaimer: International Student and Scholar Services provides this tax resource information to UI students and scholars for informational and educational purposes and not as a substitute for advice obtained from the Internal Revenue Service (IRS) or a qualified tax professional. Students and scholars who have questions about their income tax situation should consult a qualified tax professional. Each person is responsible for the accuracy of their income tax returns and any resulting penalties or interest.